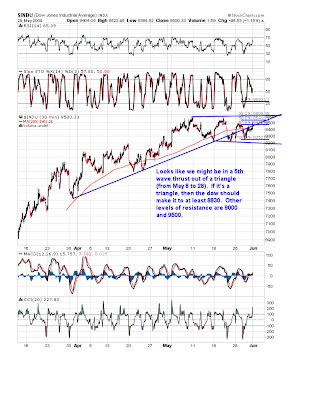

Well, the top was not on May 8th. There are many stocks that have a triangle appearance from May 8 to 28th, so for many of those, the current upswing is a terminating 5th wave in which the upswing should only last a week or so. For others, May was simply a b wave and therefore there could be another run as big as the leg since March 9th. For the stocks that I had mentioned previously. TWM should go down to 35-40, IBM up to 110, possibly 115, QCOM at least 46 and RIMM at least 90. The trend is still up, so the bear is off the table for now.

No comments:

Post a Comment