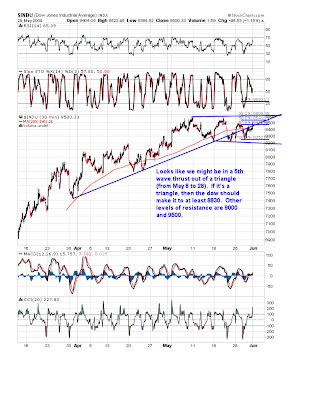

There is strong evidence that the drop in the markets since May 8th is the beginning of a new downtrend. I apologize for calling it a bit early in mid April. May 8th is a strong cycle date and there are numerous other indicators as noted on the chart. You can click on the charts to enlarge them. The small caps appear to have more potential for a stronger move to a new low. The target range for the Russell 2000 is 250-300. This can be played using TWM which is a double inverse fund. I also believe that tech stocks should take a hard hit. There are 3 in particular with appearances that suggest a strong trend down is coming. IBM (101.37) should go down to at least 70 with 50 as another possible target. RIMM now at 72 should go below 40 (unfortunately there is a large gap up to 90 making this a riskier play). QCOM has also done a beautiful retracement from it's high in mid '08. It's target is 21. Some new highs are possible but should not last long. I expect these downward moves to take approximately 5 months. Any upward moves this week in the Russell 2000 or these individual stocks should provide good opportunities to short them.

Good luck.

I apologize for the back to back posts, but an indicator has changed (vix dropping) and left me uncertain about the next move in the market. Therefore, I am exiting positions and waiting for a more clear picture.